A bit about interest

Interest is a strange quantity.

When buying a home, most of us have to borrow some of the purchase price - and then we have to decide on the terms on which we want to borrow.

Mortgages are usually cheaper than bank loans and the following is only about mortgages.

The concept of mortgages is that a large group of lenders come together and lend money to homebuyers through a credit union.

The credit union issues bonds which the lenders buy - the money is lent to the home buyers within a fixed, relatively secure framework, so that the lenders spread the risk over a very large group of borrowers.

The choices are, roughly speaking:

- Loans with or without repayments

- Loans where the interest rate is fixed for 1, 3, 5, 10, 20 or 30 years.

With or without instalments is a matter of taste. The interest rate on a loan without instalments is slightly higher, the interest rate somewhat lower and at some point in the future you will have to pay the instalments / repay the loan.

The difficult choice is the term.

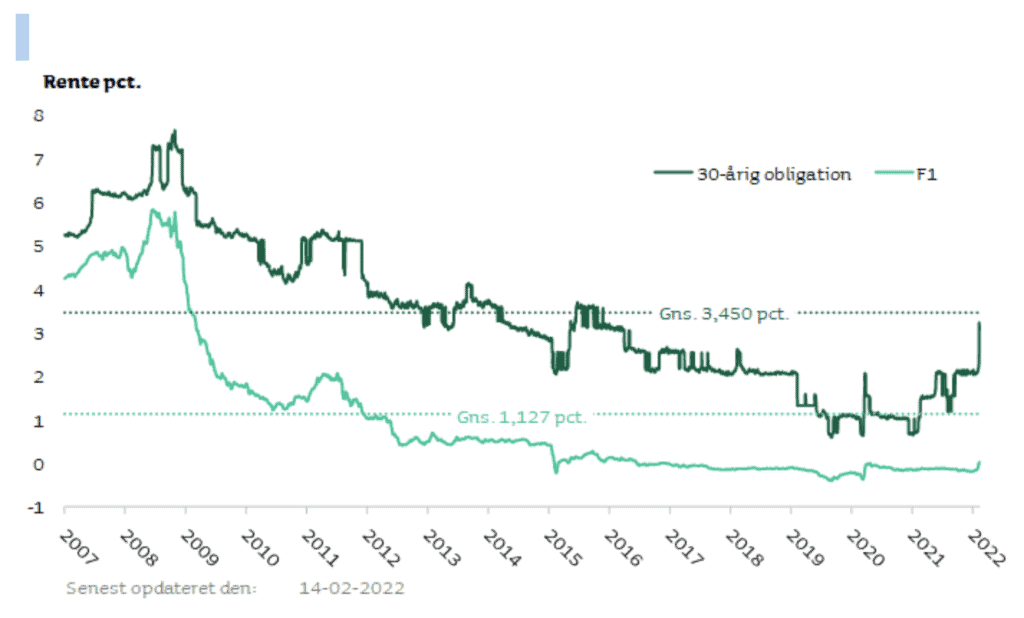

We have shown the interest rate evolution over a longer period in the graphs above.

Short-term interest rates fell over a

30-year period from over 20% to 0%.

Short-term interest rates fell over a 30-year period from over 20% to 0%.

Mortgage rates (30-year loans) fell from above 8% to below 1% between 2000 and 2020.

Comparing the 30-year mortgage rate with the 1-year mortgage rate (also called F1), the short-term rate is consistently lower than the long-term rate.

However, this does not mean that it is cheaper to take out 1-year loans than 30-year loans.

Let's assume that the interest rate right now is 2%. If we take out a 30-year loan, we know that for the next 30 years we will only have to pay 2% interest on our loan - come rain, come snow.

If we take out a 1-year loan instead, the interest rate might only be 1.5%, but it's only locked in for 1 year. After a year has passed, the interest rate for the coming year has to be fixed. If interest rates have risen to 5%, that's the interest rate you'll pay for a year - and so on.

Let's assume you get cold feet the 2nd time interest rates rise. After 2 years, the short-term interest rate is 6% and we are too scared - so now we move to a 30-year loan. Here the interest rate is maybe 6.5%, which we will pay every year for 30 years. That's a huge increase on the 2% we could have locked in.

So our conclusion is that - when interest rates are as relatively low as they are now - you should take out a 30-year fixed-rate loan, because then you know your finances for the next 30 years and you do not have to check every morning whether interest rates are going up or down.

Conversely, if interest rates are relatively high when we buy - say 7% or 8% - it might make sense to take out a 1-year (or other shorter) loan in the hope that rates will fall.

As mentioned, the loan taken out is financed by the sale of bonds by the credit union to the investors, which are banks, pension funds, foundations and individuals.

When interest rates are currently around 2%, the price of a bond is close to 100. In other words, the investor has paid DKK 100 to secure a return of 2% for the next 30 years.

But if interest rates rise to 5%, no one will give 100 and get only a 2% return on their investment - and so the price of bonds falls as interest rates rise.

At a 5% interest rate, the bond that was trading at price 100 has fallen to price 50 (estimate). This means that you, as a borrower with a 30-year fixed-rate loan, can redeem your debt at rate 50.

If you borrow 4 million today - and the interest rate has risen to 5% in 7 years when you want to sell - you can redeem your debt for 2 million. If you want to buy something else, you will have to live with the fact that you will now have to pay 5% interest on the money you borrow.

If you had taken out an F1 (1-year interest rate adjustment loan) instead, there would be no exchange rate gain.

If you had taken out an F1 (1-year interest rate adjustment loan) instead, there would be no exchange rate gain.

So there are many parameters to consider when deciding on a loan - but our clear advice is to take out a 30-year fixed rate loan if interest rates are low when you buy a home.

Low: that may be your judgement - but if you look at the curves above, you can see that in 1982 the interest rate on 2-year loans was over 20% - and that could ultimately mean you can't afford to stay in the home if interest rates rise sharply.

And if interest rates have risen sharply by the time you may be under pressure to sell, the rise in interest rates will have caused the value of your home to fall significantly, leaving you in a potentially disastrous situation. This is what happened to many people during the financial crisis around 2008.

BBBoligadvokat helps you when you need to buy a home. As a rule, we do not advise you on financing, because we do not know whether interest rates are going up or down.

However, we do know everything else that is relevant to your home purchase.